There are lots of reports about the talent challenges in the life sciences industry. The sector is in constant evolution and at the leading edge in so many ways that it’s nothing new, and no surprise, that there’s a talent gap.

But, what’s exciting and different about Lightcast’s new report developed in partnership with Cogent Skills is that it does something unique: it combines Lightcast’s workforce analytics data, official government statistics, and external employment data to look at life sciences in a more granular way than other reports. Looking through the lens of skills makes this report valuable to employers, policy makers and educators in a way that I don’t believe other reports can.

What are skills? Skills are people's abilities, knowledge, and expertise that are needed to carry out specific tasks or activities effectively. In a labour market where job titles and roles are disparate, skills form a more granular, common language that underpins every element of how work gets done – a clearer picture than job titles or other ways of assessing workforce supply and demand. Whether you’re a policy-maker, educator or life sciences business, skills are the connective tissue that join together roles, people and talent strategy.

In this article I share the five key challenges that stood out to me from this new report and how I believe the language of skills and skills data is key to addressing them.

Workforce trends in life sciences – a quick summary

Firstly, the report shows the extent of the demographic crisis in life sciences. In the UK, nearly 40% of the workforce is over the age of 45, and 16% are predicted to retire in the next 10 years. If the sector continues to grow as forecast, employment could increase by an additional 70,000 jobs by 2035, with a further 75,000 workers needed to replace those leaving the workforce. Put simply, we need more people in the sector to meet demand.

Secondly, the massive change of skills needed within jobs, and the pace of change (more to come on this later) is increasing demand for talent even further. We're seeing hot competition for technical and scientific skills, as well as high competition for common skills (such as regulatory skills) and specialist skills (such as data analytics) which are also sought in other highly-competitive sectors.

In short, the industry is growing, it has an ageing population and there is a high proportion of in-demand skills. Therefore, organisations will need to think more laterally about the challenges outlined in the report.

The top five challenges that stand out to me are:

1. Competition is everywhere

In-demand skills include those in AI and IT, resulting in hot cross-sector competition. For example, in the AI space, in-demand skills include machine learning, robotics, Python, NLP, generative AI — I can’t think of an industry that isn’t hiring for those skills! (check out Lightcast’s Global AI Skills Outlook for an in-depth look for AI skills demand). The report also finds that IT roles such as software developers, engineers, computer support specialists, and data scientists were the most advertised for by life sciences companies between April 2023 and March 2024, accounting for 13% of all online recruitment activity in life sciences.

These are just two examples of the wide-ranging and evolving skill sets in the sector and elsewhere meaning that competition really is everywhere. What does this mean for the way organisations find and develop talent and get some of the most important jobs done?

Life sciences organisations are going to have to become more resilient in the face of this change, and because the change is happening so quickly, they're going to have to have a more adaptive, more granular talent acquisition and talent strategy.

2. Skill change within jobs is transforming the way work gets done

What are the top skills for life sciences professionals? Of all the skills mentioned in life sciences job postings, approximately 64% are specialised (technical) skills, while 36% are common skills (like computer literacy and soft skills). Over half of all job postings from life sciences companies between April 2023 and March 2024 mentioned at least one digital skill. This compares to 33% of all job postings across the UK labour market for the same period.

This reinforces the point that competition for talent is everywhere! What can companies do about it? They can find these skills externally by hiring them in, or find and develop them internally. Imagine you had a choice between two candidates to fill an opening: Person A is an external applicant, with 100% of the required skills, while Person B is already within your organisation and has 80% of the required skills. Person A may require a high salary on top of the cost to recruit them, while Person B, having fewer skills, might not – and they’re already onboarded into your organisation.

Weighing these costs would require having several different types of data, including both talent intelligence on salary benchmarks and internal workforce data showing which workers have which skills. This data is easily accessible when a common language of skills flows from the internal talent marketplace to the external labour market. The advantages are enormous, the benefits real.

By combining internal and external workforce analytics, you can ensure you don’t lose out on opportunities in your existing workforce, and by default go straight out into an external, highly competitive market, when the skills you need were there all along – or very nearly there (see my previous post on the power of internal and external data to highlight talent gaps).

3. The talent market is global, but still lacking in diversity

The report shows that 15% of the life sciences population in the UK workforce is international. Despite its international nature, the majority is white. There are some interesting workforce analytics graphics in the report around diversity that shine a light on the demographics in the sector, and start to challenge thinking around where skills come from.

Diversity in the workforce brings significant benefits such as diversity of thought and innovation.

Is there an opportunity to bring in people from different socio-economic backgrounds, of different ethnicities, those with disabilities? The only way you can honestly answer the question is by looking at labour market data and skills data.

As a secondary comment, the prevalence of overseas workers also means that the sector is vulnerable to changes in immigration policy and international mobility. For example, could R&D investment disruption in the US create mobility opportunities for the UK life sciences market?

4. The demand for AI skills is double the UK average

Another report by Lightcast, the Workforce Risk Outlook Report, found that “AI has not reached the potential to alleviate severe labour shortages in industries, like healthcare, construction, and manufacturing.”

In fact, the life sciences sector has a higher-than-average and fast-growing demand for digital skills, particularly in AI. In the UK, 2% of life sciences job postings and 3% of BioPharma job postings specifically mention AI skills, compared to the national average of 1%.

How is AI used in life sciences? In-demand skills include machine learning and data science, but also specialisms around how to use AI in clinical trials, genomics, automated diagnosis, regulatory compliance and medical imaging. This reinforces point number one about competition being everywhere and highlights that this sector is particularly reliant on attracting and hiring these skills! Life sciences companies need to be able to articulate the opportunities in the sector for those with AI skills to make the sector more attractive than others.

5. An over-reliance on traditional qualifications is shrinking the talent pool

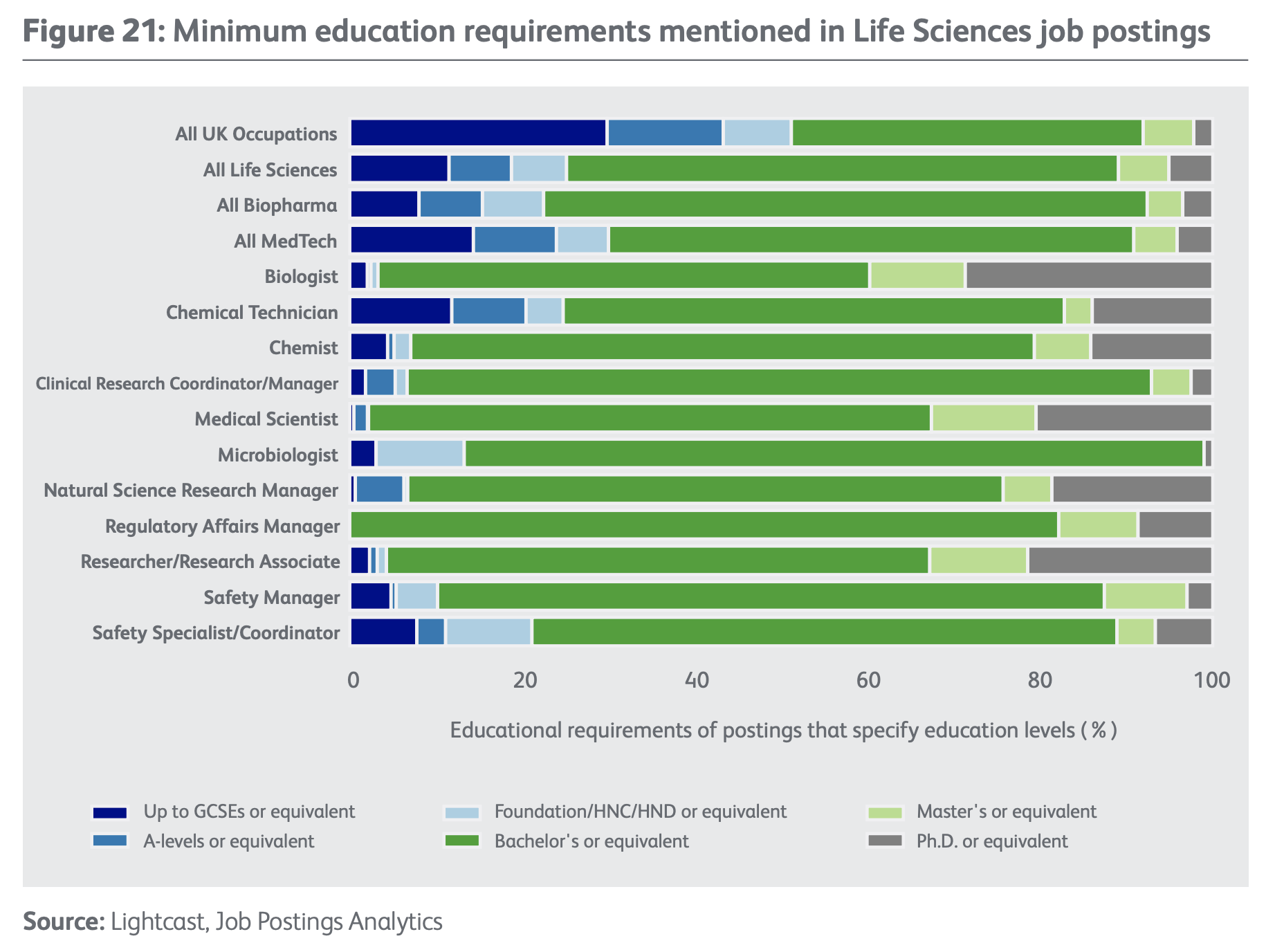

The vast majority of life sciences job postings – almost 80% – state that candidates must hold at least a bachelor’s degree or equivalent qualification, with approximately 10% of postings requiring either a master’s degree or a PhD. This is significantly higher than the UK average, where only about half of job postings mention a degree or equivalent qualification.

While this is reflective of the highly technical nature of some jobs, it increases barriers to entry and makes it harder to fill vacancies. Yes, apprenticeships are helping; between 1,450 and 1,520 apprenticeships have been offered annually since 2017/18. Plus, there has been a shift towards more higher-level apprenticeships, giving employers an alternative route to meeting their needs.

However, this huge reliance on traditional qualifications is hindering progress. If we were to look at the skills within those traditional qualifications we could consider whether they need to come via this traditional education, or are there adjacent markets that develop these skills in other ways? In a skills-based organisation, it’s much easier to see the complete picture.

Final Thoughts

These are significant challenges to work through. Using current, robust data from Lightcast can help navigate the challenges by looking through the lens of skills within jobs and your workforce. This, more granular way of looking at how work gets done, opens up more opportunities to identify talent.

Competition is everywhere. Think globally about the skills you need and use talent intelligence to uncover where they are in the external market (geographically, by sector and by employer) and who else is also hiring for them so you can shape a better proposition and a more refined talent acquisition strategy The gloves are off in the fight to find and attract talent.

Skills change within jobs is transforming the way work gets done. Stay ahead by using data on skills change that can identify core skills, common skills, and disruptive skills that will help inform talent strategy and how roles might be configured differently in future.

The talent market is global, but still lacking in diversity. Lightcast diversity data can identify underrepresented talent and expose potential new talent pools at a skills level. Plus, it can inform location strategy which is another avenue to more diverse talent.

The demand for AI skills is double the UK average. Workforce intelligence on the skills that already exist in your workforce, paired with skills data on the external market can enable decisions about where to build (internal development) and buy (hire) talent – including talent from adjacent industries. As the pace of change in skills continues, it’s essential to keep one eye on the labour market, and to adapt accordingly.

An over-reliance on traditional qualifications is shrinking the talent pool. A skills-based talent strategy will help tap into talent from unconventional backgrounds and adjacent industries by looking for a skills match at a granular level.

Why Lightcast has a unique lens on skills

When I think about why this matters, I think of Lego. Imagine a complete Lego set—a car, for instance. That's a person. Without a skills-first approach, you might only see a car. But if you look at skills, then you see that the car is made up of several smaller components. You could even put them together in new ways—applying many of the bricks you used in your car in order to build a boat.

Lightcast, if we want to extend the metaphor, helps you index every piece, so we can show you how each of them can interact with the others, because you don't want to just tear your car apart and then try to build a boat from scratch. If we imagine a person, or a role, in this same way, we can build our workforce in a more fluid way, taking into account the whole person.

If you don’t look at a person through the lens of skills, how do you know you’re seeing the whole person? If you don't look at a job through the lens of skills, how do you see the whole job? If you think about the Lego concept, you might find people with the skills you need from more diverse backgrounds or industries. You might even find the skills in people that you've already got! Without the skills data you’ll never know.

Download the full report on life sciences

If you’re working for a business grappling with the challenges of finding life sciences talent, a policy-maker, or an educator, Lightcast’s new report will give you food for thought on employer demand for specific skills as well as upskilling and re-skilling.

The Lightcast team worked with Cogent Skills and partners at Science Industry Partnership, the Office for Life Sciences, The Association of the British Pharmaceutical Industry (ABPI), ABHI, BioIndustry Association (BIA) and AstraZeneca to create this insightful report that is grounded in the latest data.